PUREFORM

Australian Horse Racing

The Edge

We all want to be competitive in everything we do. And no more so that with punting on horse racing.

Success in punting on horses, in fact most things reduces down to an information war - the people with the best information make the smart moves.

Books have been and still are the best source of general information, and this applies at least as much in the art of racehorse selection and staking as in any other field.

Author Paul Segar has produced textbooks which cover all aspects of punting. The books alone stand as a complete reference but also provide 'food for thought'. You can develop / improve your own ideas as well as learn some new techniques.

Each book is written in plain English with plenty of practical examples in each chapter. Browse the contents of each book or email for further information, if required.

Improve your punting knowledge today - buy one or all of these

books.

Read the books but want more? It's time to do a course.

The Pureform Introduction Course uses a computer program to show you how and when to bet and how to do it successfully. Check out the details

The Benchmark Handicapper Course continues from the Introduction Course and gives you further weapons to apply when making quality value selections. More...

The Introduction to Dutch Betting using the Ratings Calculator Course gives you an introduction to betting using the Ratings Calculator computer software. More...

Buy all three books now:

$70 posted

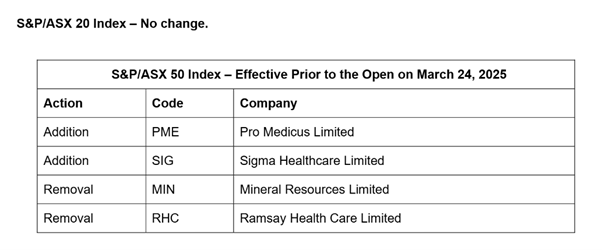

March 2025 ASX Reshuffle

The Australian Securities Exchange (ASX) will adjust its key indexes in March 2025. This rebalancing is part of the exchange's periodic review process, designed to ensure that its indexes remain representative of the evolving market landscape. The changes will affect a range of indexes, including the S&P/ASX 200, S&P/ASX 300, and other sector-specific benchmarks. The rebalancing occurs every March, June, September and December quarter.

Investors in index funds or ETFs that track the S&P/ASX 200 or S&P/ASX 300 may see underlying changes in their portfolios as fund managers adjust holdings to reflect the new index composition. This could lead to buying or selling activity in the affected stocks, potentially impacting short term prices.

The rebalancing may create opportunities for investors to reallocate their portfolios based on the new sector weightings.

More specifically, the upcoming changes as listed highlight potential opportunities.

Sigma has only recently finalised the Chemist Warehouse merger.

Given the current market weakness, the move provides a buying opportunity to accumulate shares in this company.

Fund managers have no doubt already factored in this adjustment but further upside in PME and SIG is more likely than for MIN and RHC.

Changes will take place on March 24 2025. Check on the complete list at Market Index.